Spending Freeze – I am willing to bet you that the last time you went to a shopping mall, you bought more items than you wanted. Today, when everything is just one step closer to us, and we can get anything just by ordering from our mobile at our doorstep, and too quickly, we tend to buy more and more, which leads to impulsive buying. But this habit leads us to financial problems sometimes.

Read Also: Verifying the Purity of Ghee: Comprehensive Guide to Recognize Authenticity.

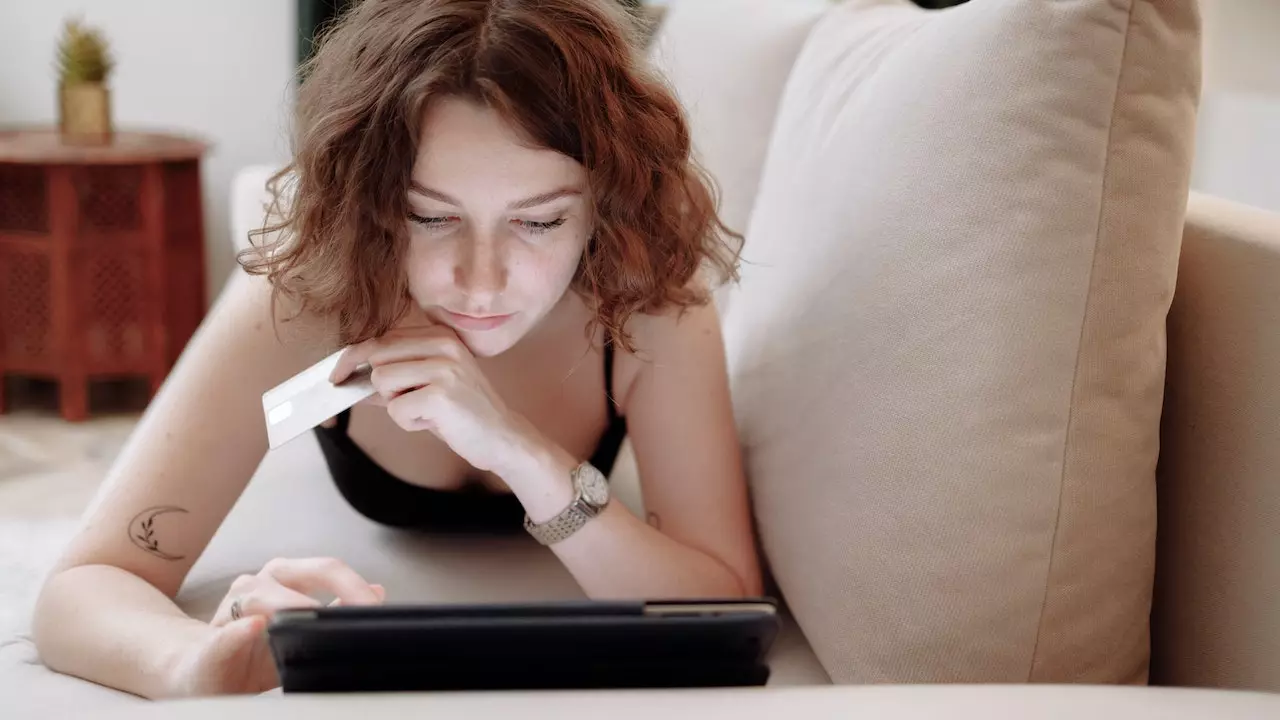

Sometimes, we spend more than we have; today, credit cards and all these lending apps have also worsened this situation. These are undoubtedly very helpful in times of emergency, but many people use these cards for their luxurious spending. The primary purpose of credit cards is to use them in case of an emergency, but we are using them in our day-to-day transactions without even taking care of what we are spending. And one day, when you have many bills payable, you will understand I should not have bought this or that.

Do you ever wonder how your temptation to spend money will lead you in the long term? Thus, there is a vital need to understand the concept of a Spending freeze. Today, in this article, we will guide you on how you can freeze your excessive spending temptations and save your future in the long term.

How to save money by Implementing a spending freeze?

We assure you that by implementing a spending freeze, you can save much more than you are saving. It’s not sure how much more you can save because it depends on your spending habits, but it is guaranteed to be more than your current savings. So, let’s dive into this article and learn how to implement a spending freeze and save more.

So, let’s first understand what a spending freeze is and how it works. In this period, you can only spend on necessities such as food, bills, and medical expenses, and you have to stop spending on anything else. Depending on your lifestyle, this period can vary from 1 week, ten days, one month, or anytime. First, you have to make a goal about how much money you need to save and what expenses are essential. Then, if any other expense occurs, you have to reason about whether you need to spend on this expense or if there are any alternatives.

Be sure when you have implemented freezing on your spending, you should not incur any extra expenses. This is just a situation of being creative. For instance, what will you do when one of your friends asks you for dinner but he has not met you for a very long time, or what will you do if an appliance breaks at your house? This will be your time to go on YouTube and watch how to fix that. Thus, working on these situations will make you more mindful and grateful for the money.

Freezing your spending is not a complex task. Instead, it is just a creativity about how to behave in a situation, like appreciating the things you have and not spending on buying other things.

Rules For Implementing Spending Freeze

The time for Freezing spending will vary from person to person as it’s based on your lifestyle, how much money you want to save for a particular period and your perspective toward your wants and needs. But here are some basic rules everyone must follow to implement a spending freeze.

- Decide your “why” ahead of time.

- Get the other people in your household on board.

- Make a list of things that you can buy (i.e., groceries, prescriptions, gas for your car)

- Determine how long your spending freeze will last.

- Don’t go out and spend a lot of money in preparation for your freeze, as this negates the purpose of the freeze altogether.

Once you have set these rules, it is time to learn how to implement freezing on your spending, and here is how you can do it.

8 Steps to Implement a Spending Freeze in Your Life

Prepare Yourself

The first and most crucial step in the implication of the spending freeze is to prepare yourself so that you do not need to spend more to prepare for the implementation of freezing on your spending. Instead, it will just wrong the principle of it. By preparing yourself, we mean that first, you must understand your basic needs and the difference between your needs and wants.

And it should not be like you go for groceries and come out with your hands full of bags, and then you will never be able to implement the freeze. Instead, it would be best to learn to buy only the necessities. Apart from this, the timing to implement this rule also matters; if you are going for a trip outside with your friends, it will be the worst idea to implement freezes on your spending.

Determine a Reasonable Time Frame

The next thing you have to do is to determine a reasonable time frame for the freeze. If you have not done it before, you should start with just a week to feel comfortable with it, and then when you feel like doing it, you can gradually increase the time frame from one week to two weeks and then months.

But with time, it will become difficult for you to control, so take proper gaps between your time of spending freeze. And that also does not mean spending all at once in your break. It would be best if you learned how to control your excessive spending.

Find Some Creative Entertainment

Are you also the one who spends a lot on entertainment things like movies, playing paid games, and so on? Then, it would be best to learn how not to engage in them. Rather than going to the movies, you should learn to find some creative entertainment.

You can go to libraries or go outside with kids in parks where you can play outdoor games or perform yoga, free of cost and a great medium of entertainment and relaxation. Apart from this, these are good for your health. It would be best to learn not to spend on outside movies, food, or games rather than learn to enjoy with your family in your free time, read books, and go out in parks.

Challenge Your Thoughts

It will be complex for you to challenge your thoughts and convince yourself not to buy things that are not necessary. You should write down all the spending you did and then categorize them as most important to least important, and then you should challenge yourself about whether you need those things. This will help you determine where you are overspending, and then you can cut those extra expenses and save your money for the best.

Set Up a Place for This Extra Money

Next, you should set up a place to deposit the money you have saved during your spending freeze time period. That place should not be easily accessible like a new bank account, which does not have any debit card attached to it, or deposit in short-term FD as per your financial goals; thus, you will feel like it has already been spent and will end up with saving a considerable amount of money.

Make Sure You’re Holding Yourself Accountable

The most important and challenging thing in a spending freeze is to hold yourself accountable. For this, you can get help from one of your friends who can ask you daily about your progress, or it would even be better if you both do a spending freeze as you both be accountable to each other and motivate each other to stay on track.

Eat Through Your Pantry

Food is where we all spend a lot of money, and some even spend all of their money on food, but when you’re in your money freeze time, you should learn how not to say no to outside foods. We all crave pizzas, burgers, and those delicious pasta but don’t want to cook for ourselves. These online food delivery apps have made ordering food with just a tap of our hands very easy.

But if you have decided to freeze your spending habits, you should make a weekly meal plan to eat all out of the pantry and don’t need to go outside for food. It will help you save a lot on food. Watch YouTube, as you can get numerous food ideas to prepare using your pantry.

Learn From Your Experience

This spending freeze may be short-term, but if you tend to follow this habit, you will have a good amount of money saved for your future. For example, we spend on things like drinking coffee on our way to work, but it takes us to pay a lot more, which we can save by preparing our coffee at home. To find out these types of your habits and cut your extra spending. These will be lifelong beneficial for you.

So these are the simple steps to implement a spending freeze, which you should adopt in your life. These are the small habits that will be beneficial for you in a long time. It will help you save money, and now you can buy that dream house or have some unique things for your family that you were dreaming of. This is an excellent habit that can be proven helpful in times of financial emergency. So implement these habits of money freeze and save yourself from any future financial crisis.

To get more of our exclusive content on Health Care and Lifestyle. Follow us on YouTube and Instagram.