The monetary industry has witnessed a tremendous transformation driven by technological improvements in recent years. Among those innovations, the emergence of robo-advisors and algorithmic buying and selling has been especially noteworthy. These technologies automate investment control and buying and selling techniques, presenting new possibilities for individuals and institutional investors.

What Are Robo-advisors?

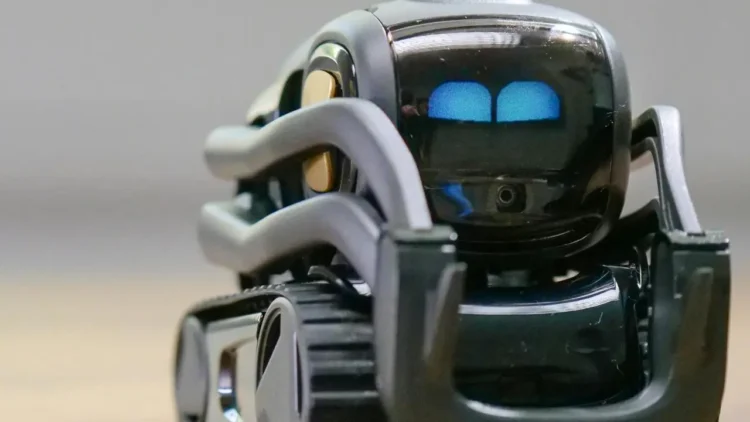

Robo-advisors are digital platforms offering computerized, algorithm-driven monetary-making plan offerings with little human supervision. Using sophisticated algorithms, these structures create and control an assorted portfolio of investments based totally on a man or woman’s threat tolerance, monetary dreams, and funding horizon. The procedure generally starts with the user completing a questionnaire to evaluate their economic situation and alternatives. Based on these records, the robot marketing consultant allocates belongings and periodically rebalances the portfolio to keep the desired degree of threat.

Read Also: Top 5 Healthy Snacks to Munch on All Day Long.

The primary benefit of robo-advisors is their accessibility and affordability. They democratize access to financial advice, making it available to a broader target market that might not have the resources to hire traditional economic advisors. Additionally, robo-advisors regularly charge lower prices than human advisors because automation reduces operational fees.

Algorithmic Trading:

Automation in Action Algorithmic buying and selling, also called algo-buying and selling, involves laptop algorithms to execute trades at speeds and frequencies that might not be possible for human investors. These algorithms can examine enormous numbers of statistics, become aware of trading opportunities, and execute orders based on predefined criteria. The techniques employed in algorithmic trading can range from simple, rule-based methods to complex system-learning models that continuously adapt to marketplace situations.

One significant advantage of algorithmic trading is its capacity to reduce human error and emotion in trading selections. Algorithms can execute trades based on natural data and common sense, removing biases that could cloud human judgment. Moreover, the speed and performance of algorithmic trading can result in better pricing and decreased transaction charges.

The Synergy Between Robo-advisors and Algorithmic Trading

Integrating robo-advisors and algorithmic trading is developing a powerful synergy inside the funding management landscape. Robo-advisors leverage algorithmic buying and selling to optimize portfolio management, ensuring that investment selections are based on actual-time facts and complex evaluation. This mixture enhances the potential to reap preferred financial outcomes with greater precision and consistency.

For instance, robo-advisors and algorithmic trading can implement tax-loss harvesting strategies, which systematically promote securities at a loss to offset gains and decrease taxable income. This stage of sophistication was formerly available and was most straightforward to high-net-worth individuals with access to superior financial offerings.

Challenges and Considerations

Despite the various blessings, there are challenges related to robo-advisors and algorithmic trading. The reliance on algorithms and automation raises concerns about the lack of personalized human contact and the capacity for technical system defects or failures. Additionally, the growing use of algorithmic trading has led to worries about market balance and the capacity for flash crashes caused by high-frequency trading algorithms.

Investors must also be aware of the underlying assumptions and boundaries of the algorithms used by robo-advisors. While these structures are designed to perform well underneath traditional marketplace situations, they may not continually account for excessive or unexpected events.

The Future of Investment Management

The rise of robo-advisors and algorithmic trading marks a massive shift in how funding management is approached. These technologies are making monetary services more reachable, efficient, and tailor-made to man or woman desires. As they continue to evolve, we can expect even greater levels of innovation, further remodeling the landscape of investment control.

In the end, robo-advisors and algorithmic buying and selling are at the vanguard of a monetary revolution, automating investment management and trading strategies to deliver greater specific, facts-driven outcomes. While demanding situations stay, the capacity blessings for investors are substantial, heralding a new technology of monetary empowerment and efficiency.

To get more of our exclusive content on Health Care and Lifestyle. Follow us on YouTube and Instagram.